will capital gains tax rate change in 2021

Accordingly in 2021 individuals who earn between 41400 and 47800 their total taxable income will not be liable for capital gains tax. The maximum capital gains are taxed would also increase from 20 to 25.

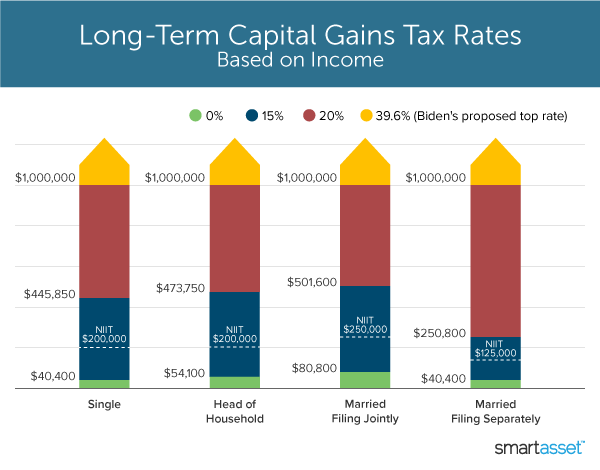

What S In Biden S Capital Gains Tax Plan Smartasset

How much you owe in capital gains largely depends on how long you held the investment your filing status and the tax bracket you fall into.

. If you sell small-business stocks or collectibles the maximum capital gains tax rate is 28. Since the 2021 tax brackets have changed compared with 2020 its possible the rate youll pay on short-term gains also changed. To see how the thresholds will change from 2021 to 2022 here are the figures for the 2022 tax year.

If your income was between 0 and 40400. Currently the capital gains tax rate for wealthy investors sits at 20. You will be taxed at your ordinary income tax rate on short-term capital gains.

The income thresholds for the capital gains tax rates are adjusted each year for inflation. 1 day agoWhere Will The Capital Gains Rate Be On Ustral Gains Rate For 2021. Form 8949 and Schedule D are the two forms you need to map out capital losses and capital gains.

The tax rate on most net capital gain is no higher than 15 for most individuals. Long-term capital gains taxes are assessed if you sell investments at a profit after owning them for more than a year. The current long-term capital gains tax rates are 15 20 or 238 for higher income taxpayers.

If you are filing your taxes as a single person your capital gains tax rates in 2021 are as follows. House Democrats propose raising capital gains tax to 288 Published Mon Sep 13 2021 333 PM EDT Updated Mon Sep 13 2021 406 PM EDT Greg Iacurci GregIacurci. In 2021 long-term capital gains will be taxed at 0 15 or 20 depending on the investors taxable income and filing status excluding any state or local capital gains taxes.

Short-term capital assets are taxed at your ordinary income tax rate up to 37 for 2022. 0 to 20550. The tables below show marginal tax rates.

Congress hasnt made changes to rates on long-term capital gains and dividends for 2021 and 2022. Will capital gains change in 2021. If your income was between 40001 and 445850.

If their income is between 40401 and 445850 they will pay 15 percent on capital gains. 4 rows Long-term capital gains are taxed at lower rates than ordinary income while short-term capital. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 for most assets held for more than a year.

Joe Biden says this tax increase funds a 18 trillion dollar. 13 2021 and will also apply to Qualified Dividends. There are exceptions to this such as when it was 15 from 2004 to 2012.

One of the proposals Congress is considering sets the top rate for taxing capital gains at 25 up from 20 under current law. This new rate will be effective for sales that occur on or after Sept. This article will help you understand Capital Gains Tax.

Historically capital gains tax has sat around 20. Heres a peek at the 2022 short-term capital gains rates for those who break up with their stocks early. Additionally a section 1250 gain the portion of a.

The rates do not stop there. Assets other than stocks may have different rates for capital gains taxes. Some or all net capital gain may be taxed at 0 if your taxable income is less than or equal to 40400 for single or 80800 for married filing jointly or qualifying widow er.

The Impact of a Change in Capital Gains Tax on a Sellers Net Proceeds The model the results and how to interpret them. Long-term capital gains are. 2022 Capital Gains Tax Rate Thresholds.

There is a change on the horizon which can take place as soon as 2022. The proposal is bumping this up to 396. 7 rows 2021 federal capital gains tax rates.

Depending on how long you hold your capital asset determines the amount of tax you will pay. For assets held less than one year short-term gains are taxed at regular income rates which may be as high as 34 based on the taxpayers individual income. Another would raise the capital gains tax rate to 396 for taxpayers.

Capital Gains Tax Rate 2021. If your income was 445850 or more. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35.

In each scenario we calculate the change in the present value of net proceeds from a deal completed in 2021 under the current capital gains tax rates vs.

2022 And 2021 Capital Gains Tax Rates Smartasset

2022 And 2021 Capital Gains Tax Rates Smartasset

Capital Gains Definition 2021 Tax Rates And Examples

2021 Capital Gains Tax Rates By State Smartasset

Capital Gains Definition 2021 Tax Rates And Examples

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Capital Gains Tax Advice News Features Tips Kiplinger

Capital Gains Definition 2021 Tax Rates And Examples

Capital Gains Tax Rates 2021 And How To Minimize Them Union Bank

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Capital Gains Tax What Is It When Do You Pay It

2021 Capital Gains Tax Rates By State Smartasset

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

What S In Biden S Capital Gains Tax Plan Smartasset

What Capital Gains Tax Changes Could Mean For Cre Investors Leverage Com

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

2022 And 2021 Capital Gains Tax Rates Smartasset

How Do State And Local Individual Income Taxes Work Tax Policy Center